A first look at today’s Spring Statement as delivered by Rachel Reeves, Chancellor of Exchequer. As always this review is focused around the areas of relevance to our clients, and it is E&OE. Further details always tend to unfold over coming days.

Context

Over recent years different Chancellors have swapped between Spring and Autumn Budgets, and tend to match these with another “Fiscal Event” roughly six months apart. Of course Covid, and some rather rash decisions taken by the short lived Truss Government, have led over the last five years to additional “Mini Budgets”. The second Fiscal Event of the year, normally Spring Statement or Autumn Statement is sometimes focused just on the Economy, on other occasions has been a Budget in all but name.

The current Government promised us one Budget a year, the first being last October, and made it clear the Spring Statement would not make significant policy announcements. Despite a challenging Geopolitical climate in recent months, thats more or less what we got today – an update rather than a long list of detailed policy announcements. Credit to the Chancellor for sticking to the intention, although I’m sure many will be disappointed that their particular tax agenda / perceived unfairness / hobby horse wasn’t addressed.

There were some tax policy announcements though, notably around Making Tax Digital, and we’ve addressed these below.

Overshadowing all of this is a very volatile Geopolitical landscape. If the US de-funds its Nato commitments then we could be looking as a country at funding, say, £50bn a year of extra defence costs – against an extra £2bn a year announced today. Even if Nato holds together its clear that Europe, including the UK, will need to contribute more to Ukraine and to regional security. Tariffs and possible trade wars add to concerns.

Whether the Manifesto pledge given by the Government around not raising Income Tax, NI, or VAT can be sustained must be a question for us all given the turbulence emanating from Washington.

Performance of the Economy and Predictions

The Office for Budget Responsibility (OBR) reported that the UK economy experienced stagnation in late 2024, with real GDP growth of just 0.1% in the last two quarters. This sluggish performance was attributed to weaker productivity growth and declining business and consumer confidence. Real GDP per capita decreased by 0.9% in 2023 and 0.1% in 2024.

Looking ahead, the OBR forecasts modest economic growth of 1.0% in 2025, a downward revision from previous estimates. Growth is expected to increase to 1.9% in 2026. Cumulatively, the economy is projected to expand by 9.4% from Q4 2024 to Q1 2030.

- Growth – The Office for Budget Responsibility (OBR) has revised the UK’s growth forecast for 2025 downwards, from an initial 2% to 1%.

- Productivity – OBR suggests this is sluggish, around 1% lower than anticipated.

- Inflation – Inflation is expected to peak at 3.8% in July 2025 before gradually declining to 2.1% by 2026. This trajectory reflects anticipated fluctuations in energy and food prices, as well as wage growth factors.

- Borrowing – The government’s fiscal strategy aims to transition from a deficit of £36.1 billion in 2025-26 to a surplus of £9.9 billion by 2029-30.

Government Spending

Major Highlights on Government Spending were:

- Defence & Security – £2.2bn annual investment, this increase is part of the government’s plan to raise defence expenditure to 2.5% of GDP by 2027.It is hoped that increased defence spending will lead to wider economic growth in areas like AI and emerging technologies.

- Overseas Aid – Reduction of foreign aid budget to 0.3% of Gross National Income, saving £2.6bn by 2030.

- NHS – no new funding

- Local Government – no new funding

- Transport and Infrastructure – reallocation of funding from cancelled HS2 phases to infrastructure projects like Northern Powerhouse Rail, rail in the Midlands and North, and local bus and tram services.

- Infrastructure Investment – £13 billion increase in capital infrastructure spend over the next five years; construction skills package to train up to 60,000 more skilled workers; additional £2 billion in social and affordable housing.

Changes to spending on Social Security were announced recently with further refinement in the Spring Statement:

- Universal Credit Adjustments:

-

The health element of Universal Credit for new claimants will be halved starting next year, with the top-up frozen at £50 per week until 2030

-

-

Personal Independence Payment (PIP) Reforms:

-

The government plans to tighten eligibility criteria for PIP by 2026, making it more challenging to claim.

-

Approximately 800,000 individuals are projected to lose around £4,500 annually due to these changes.

-

-

Carer’s Allowance Impact:

-

An estimated 150,000 unpaid carers are expected to lose their Carer’s Allowance, adding financial strain to affected households.

-

-

Projected Savings:

-

The Office for Budget Responsibility forecasts that these welfare reforms will save £4.8 billion from the welfare budget by 2029-30

-

Taxation Measures

The major tax announcement was a commitment to lower the entry threshold for Making Tax Digital for Income Tax Self Assessment to £20,000 from April 2028.

This means staging for MTD for ITSA is:

- April 2026 £50,000 turnover

- April 2027 £30,000 turnover

- April 2028 £20,000 turnover

How this is meant to drive economic growth is anyone’s guess.

It was also announced that HMRC won’t be providing a free to use filing service; all impacted businesses will need to use commercially available solutions, including for the filing of their end of year reporting which takes the place of the current Self Assessment.

This impacts Sole Traders and Landlords.

Other tax announcements:

- Further measures to crack down on Tax Avoidance Schemes and their promotion.

- Measures to reduce tax debt – apparently unpaid tax liabilities are £44bn, double that of five years ago (remind me, was there a pandemic or something?), of which £20bn is over 12 months old and “harder for HMRC to collect”.

- Increase HMRC criminal investigations by 20%.

- New HMRC reward for informants scheme (“Snitch Tax?”).

- HMRC and Companies House joint plan to tackle phoenixism – we see abuses in this area regularly, so its to be welcomed. The project is to tackle “contrived insolvencies” and genuine business failures should not be impacted.

- High Income Child Benefit Charge (HICBC) – new measures to take HICBC payers out of Self Assessment – this is a positive step to eliminate an overly complex part of the tax and benefit system which was never properly thought through.

A lot of store is being put on HMRC to tackle abuse – and yet I read this morning of a case where they have failed to change an accountant’s address for over ten years, despite being told repeatedly. Anyone who deals regularly with HMRC will wonder if they are up to this challenge.

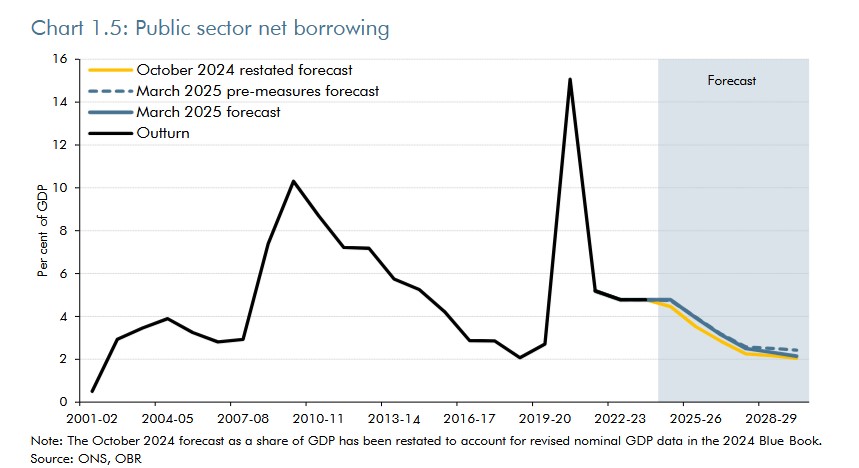

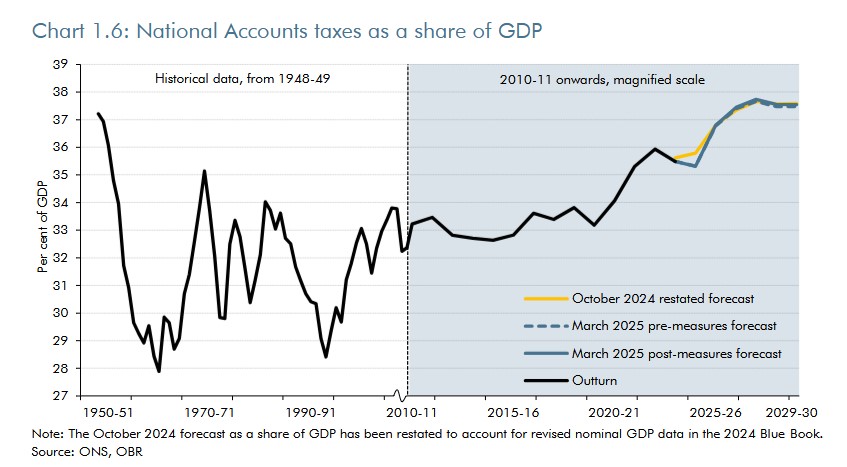

A Couple of Charts

These are from the Office of Budget Responsibility (OBR) report:

This chart shows the UK Government’s borrowing. Unsurprisingly there are peaks in 2009 and 2020 relating to the Financial Crash and the Pandemic. You can see pandemic borrowing was higher than the financial crash, but it is expected to be repaid quicker.

This chart shows the UK government’s tax take as a proportion of the overall national income (GDP). By the end of this Parliament it will be the highest since 1948.

All charts (c) OBR

Conclusions

Not the rosiest of pictures economically. There is a plan to get us out of this, but the window of success for the Government is narrow.

Meanwhile, consumer and business confidence will inevitably remain subdued.